to break the dominance of the US dollar in global trade

The big launch of the BRICS bank is seen as a first step to break the dominance of the US dollar in global trade, as well as dollar-backed institutions such as the International Monetary Fund (IMF) and the World Bank, both US-based institutions BRICS countries have little influence within.

In terms of escalating international competition the task of activating the trade and investment cooperation between BRICS member states becomes important, Putin said.

Russia, Brazil, India, China and South Africa account for 11 percent of global capital investment, and trade turnover almost doubled in the last 5 years, the president reminded.

Each BRICS member is expected to put an equal share into establishing the startup capital of $50 billion with a goal to reach $100 billion. The BRICS bank will be headquartered inShanghai, India will preside as president the first year, and Russia will be the chairman of the representatives. Each country will send either their finance minister or Central Bank chair to the banks representative board.

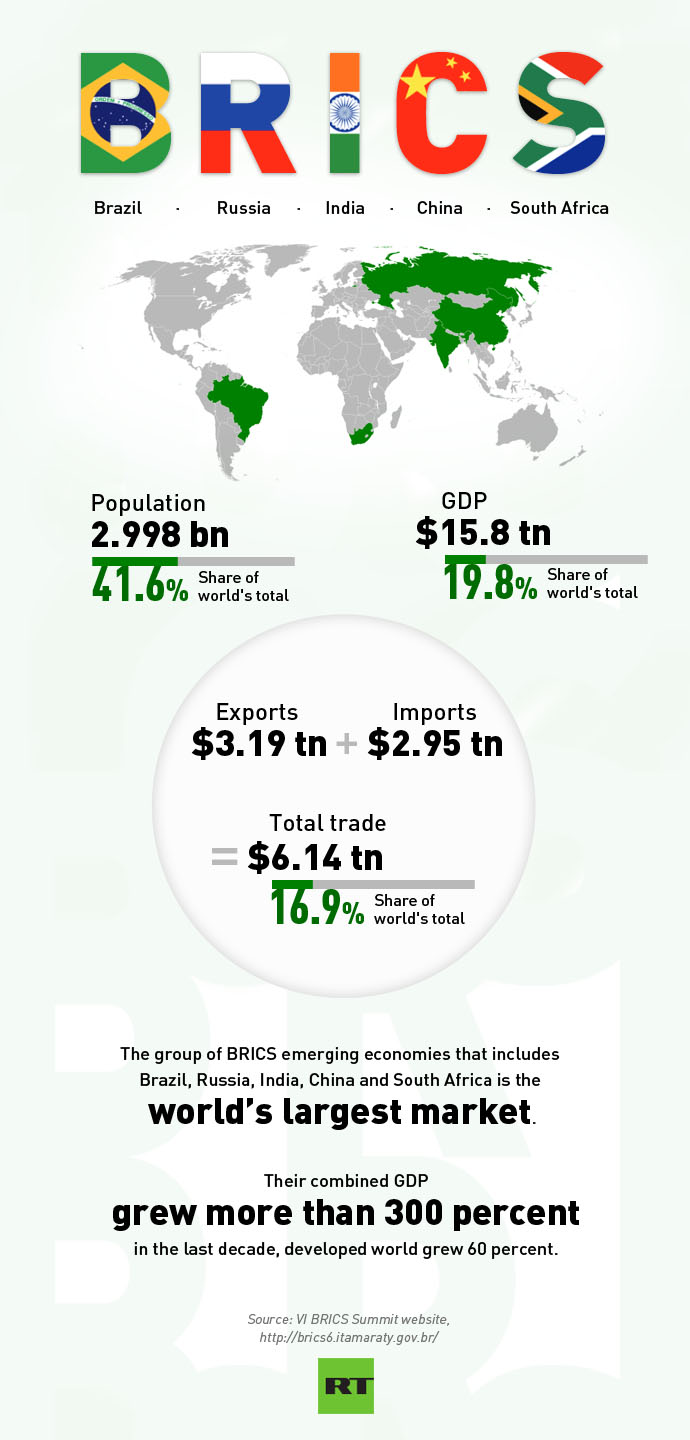

BRICS represents 42 percent of the worlds population and roughly 20 percent of the worlds economy based on GDP, and 30 percent of the worlds GDP based on PPP, a more accurate reading of the real economy. Total trade between the countries is $6.14 trillion, or nearly 17 percent of the worlds total.

The $100 billion crisis lending fund, called the Contingent Reserve Arrangement (CRA), was also established. China will contribute the lions share, about $41 billion, Russia, Brazil and India will chip in $18 billion, and South Africa, the newest member of the economic bloc, will contribute $5 billion.

The idea is that the creation of the bank will lessen dependence on the West and create a more multi-polar world, at least financially.

This mechanism creates the foundation for an effective protection of our national economies from a crisis in financial markets,” Russian President Vladimir Putin said.

The group has already created the BRICS Stock Alliance an initiative to cross list derivatives to smooth the path for international investors interested in emerging markets.

Russia has also proposed the countries come together under an energy alliance that will include a fuel reserve, as well as an institute for energy policy

“We propose the establishment of the Energy Association of BRICS. Under this umbrella, a Fuel Reserve Bank and BRICS Energy Policy Institute could be set up, Putin said.

Documents on cooperation between BRICS export credit agencies and an agreement of cooperation on innovation were also inked.

Bringing emerging economies closer has become vital at a time when the world is guttered by the financial crisis and BRICS countries cant remain above international problems, said Brazil’s President Dilma Rousseff.

She cautioned the world not to see BRICS deals as a desire to dominate.

We want justice and equal rights, she said.

The IMF should urgently revise distribution of voting rights to reflect the importance of emerging economies globally, Rousseff said.

The big launch of the BRICS bank is seen as a first step to break the dominance of the US dollar in global trade, as well as dollar-backed institutions such as the International Monetary Fund (IMF) and the World Bank, both US-based institutions BRICS countries have little influence within.

The big launch of the BRICS bank is seen as a first step to break the dominance of the US dollar in global trade, as well as dollar-backed institutions such as the International Monetary Fund (IMF) and the World Bank, both US-based institutions BRICS countries have little influence within. (L to R) Russia’s President Vladimir Putin, India’s Prime Minister Narendra Modi, Brazilian President DilmaRousseff, China’s President Xi Jinping and South Africa’s President Jacob Zuma join their hands during the official photograph of the 6th BRICS summit in Fortaleza, Brazil, on July 15, 2014 (AFP Photo)

(L to R) Russia’s President Vladimir Putin, India’s Prime Minister Narendra Modi, Brazilian President DilmaRousseff, China’s President Xi Jinping and South Africa’s President Jacob Zuma join their hands during the official photograph of the 6th BRICS summit in Fortaleza, Brazil, on July 15, 2014 (AFP Photo) 3 ways America should be more like Canada

3 ways America should be more like Canada

ILLINOIS Budget + Tax Policy

ILLINOIS Budget + Tax Policy

Now, that’s a Top Cop!

Now, that’s a Top Cop!

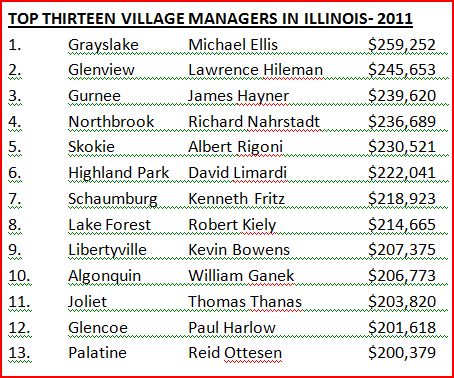

Top 13 Big Dog Village Manager Salaries- IL

Top 13 Big Dog Village Manager Salaries- IL